The tides are turning in North American trade. After holding the top spot for years, China has been dethroned by its southern neighbor: Mexico. This historic shift marks a significant change in the U.S.-Mexico economic relationship. Traditionally, complex trade ties, including tariffs, regulations, and cultural influences, have defined this partnership. However, recent years have seen a rise in tensions with China, prompting U.S. companies to look elsewhere for reliable trade partners.

Mexico has stepped up to fill this void. Data from the U.S. Department of Commerce reveals a clear trend. In 2023, U.S. imports from Mexico surged by 4.6%, reaching a staggering $475.6 billion. Conversely, imports from China plummeted by a significant 20.3%, dropping to $427.2 billion. This dramatic shift positions Mexico as the U.S.’s biggest exporter for the first time in twenty years, highlighting the growing importance of this strategic trade relationship.

Table Of Contents:

- Understanding the Dynamics of U.S.-Mexico Trade Relations

- Impact of Tariffs on China’s Exports

- Mexico as a Manufacturing Powerhouse

- The Rise of Mexico as a Manufacturing Base

- Automotive Industry: A Key Player in Mexico’s Manufacturing Scene

- Investment Opportunities in Mexico’s Regional Hotspots

- Diversification of Mexico’s Supply Chain

- Leading U.S. Exports and Imports in Trade with Mexico

- FAQs in Relation to U.S. Trade With Mexico

- Conclusion

Understanding the Dynamics of U.S.-Mexico Trade Relations

Embark on an exploration of the vibrant trade interactions that bind the United States and Mexico, two giants in commerce. We’re about to dissect the intricate bond that significantly influences the financial landscapes across the border.

The Role of NAFTA and USMCA in Shaping Trade

The North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), are far more than just acronyms. These agreements are the cornerstones of trade between the United States, Mexico, and Canada.

Implemented in 1994, NAFTA significantly reduced tariffs and barriers to trade between the three countries. This led to a surge in cross-border commerce, creating a more integrated North American market.

Since July 1st, 2020, when USMCA took over from NAFTA, it wasn’t just a name change. It was about fine-tuning rules to give U.S. companies better shots at success in Mexico’s diverse market. And let me tell you, these opportunities are as vast as an open road stretching across deserts and mountains between our countries.

NAFTA to USMCA: A trade evolution enhancing U.S. trade with Mexico.

Trade Deficit: A Closer Look

The term “trade deficit” frequently appears in discussions about international trade, and it can sound concerning. However, the implications of a trade deficit are more nuanced than a simple positive or negative label.

Let’s take a closer look at the U.S.-Mexico trade relationship. In 2022, the total value of goods exchanged between the two countries reached a staggering $863.4 billion. While the U.S. exported $362.7 billion worth of goods to Mexico, it imported $500.7 billion, resulting in a trade deficit of $138 billion for the United States.

But here’s the key point: a trade deficit doesn’t necessarily signify negative consequences. In this case, it reflects a robust and active trading relationship that creates jobs and fosters economic growth in both countries. The trade balance itself fluctuates year-to-year, influenced by various factors such as consumer demand, supply chain fluctuations, and even global events.

Impact of Tariffs on China’s Exports

The world of international trade got a bit shaken up when the U.S. decided to slap tariffs on Chinese exports. But, it’s not just about the U.S. and China; this move has sent ripples all the way to Mexico, reshaping trade dynamics in ways we’re just beginning to understand.

U.S. tariffs on China reshaped global trade dynamics, impacting Mexico.

How Tariffs Affected U.S. and Mexico’s Trade Dynamics

When those tariffs hit, it was like a starting gun for changes across North America.

- Mexico saw an opportunity and took it, becoming more attractive as a manufacturing base.

- This shift wasn’t overnight but part of larger trends accelerated by these imposed tariffs.

- Firms began navigating around these new costs by moving parts of their operations closer home – Mexico.

- Almost overnight, the skirmish over tariffs transformed into a windfall for Mexico’s production and exporting prowess, notably in industries such as cars and gadgets which China once ruled.

We can’t ignore how this shake-up also brought challenges – from strained supply chains trying to adapt to new realities to businesses grappling with increased production costs outside China. But one thing is clear: This wasn’t just about who could send goods where at what price. It was about sparking shifts in global manufacturing strategies – ones that have placed Mexico firmly on many companies’ radar as both a valuable partner and competitor on the world stage.

All eyes are now watching how these adjustments play out long-term for North American trade relations. Because let’s face it — when you tweak one part of our interconnected global economy puzzle? The whole picture needs rearranging.

Mexico as a Manufacturing Powerhouse

Mexico has emerged as a major player in the global manufacturing landscape, and a key factor in its success is its extensive network of free trade agreements. Boasting 13 such agreements as of today, Mexico enjoys preferential trade access with not only North America (through USMCA, the successor to NAFTA), but also with roughly 50 countries worldwide.

The Rise of Mexico as a Manufacturing Base

The USMCA plays a particularly crucial role. This agreement eliminates or significantly reduces tariffs on goods traded between the U.S., Mexico, and Canada. This translates to smoother and more affordable movement of goods across borders, streamlining supply chains and making it easier and cheaper for manufacturers to get their products to market. This advantage becomes even more pronounced compared to China, which faces ongoing trade tensions with the U.S.

The year 2023 witnessed a remarkable surge in the trade of manufactured goods between Mexico and the U.S., reaching a staggering $196.7 billion in the first four months alone—an impressive 8% escalation compared to the corresponding period in 2022. Within the broader spectrum of trade, which amounted to $593 billion in exports during 2023 between the two nations, manufactured goods accounted for a substantial 89.2%.

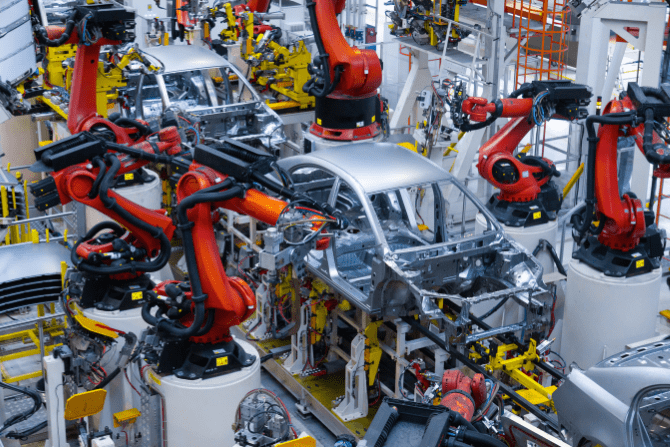

Automotive Industry: A Key Player in Mexico’s Manufacturing Scene

Mexico’s manufacturing sector has seen a remarkable boom, with the automotive industry acting as a key driver. This isn’t just about assembling cars anymore. Mexico has transformed into a powerhouse for high-tech auto parts, supplying critical components for vehicles ranging from sedans to SUVs across the globe. The sheer scale of this transformation is evident in the staggering export figures: in 2023 alone, Mexican factories shipped over $427 billion worth of auto parts.

This success story didn’t happen overnight. Mexico’s rise in the automotive sector is deeply intertwined with the North American Free Trade Agreement (NAFTA). The impact of NAFTA is undeniable. During the two decades it was in effect (until 2024), Mexico’s light vehicle production skyrocketed. Production more than tripled, jumping from 1.1 million units in 1994 to nearly 3.5 million units in 2016. Similarly, exports followed suit, with a dramatic increase from 579,000 units to a staggering 2.8 million units during the same period.

✐ Key Takeaway:

Mexico’s on fire in the manufacturing game, especially with autos. Thanks to nearshoring and tech innovation, it’s not just about assembly anymore. They’re a global leader now, making moves that matter.

Investment Opportunities in Mexico’s Regional Hotspots

Mexico isn’t just about the sunny beaches and mariachis; it’s a land brimming with investment goldmines. Diving deeper, we’re now focusing on the specific areas within Mexico that are drawing in investors like moths to a flame.

Mexico transforms into a key global manufacturing hub, excelling in car production.

Identifying Top Investment Regions in Mexico

First off, know this: Mexico is big. And within its vast lands lie regions that could make your wallet much thicker. We’re talking manufacturing powerhouses like Bajio, tech hubs in Guadalajara, and financial centers in Monterrey. Each region has its own flavor of opportunity.

- Bajio: This area is an industrial giant. Think cars and aerospace.

- Guadalajara: It’s not called the Silicon Valley of Mexico for nothing. Tech startups love it here.

- Monterrey: Money talks louder here than anywhere else in Latin America. Think of Real Estate giants.

The 14th-largest economy globally, as per trade.gov, keeps getting better thanks to external demand and foreign direct investment (FDI).

Why These Regions are Attracting Investors

Mexico’s attractiveness as an investment destination is fueled by several factors:

- Strong Growth: Mexico boasts the 14th largest economy globally (according to trade.gov) and continues to experience positive economic growth driven by external demand and foreign direct investment (FDI).

- Strategic Location: Beyond the regional strengths of Bajío, Guadalajara, and Monterrey, there’s another key factor propelling Mexico’s attractiveness to investors: its geographical location. Sharing a nearly 2,000-mile border with the United States, Mexico boasts convenient overland access to the world’s largest economy.

- Skilled Workforce: Mexico has a large pool of skilled labor, making it an attractive location for companies seeking a qualified workforce.

- Favorable Trade Agreements: Mexico’s network of free trade agreements, including the USMCA, offers investors preferential access to various markets

Diversification of Mexico’s Supply Chain

Mexico is mixing up the game by diversifying its supply chain strategies.

How Mexico is Reducing Dependence on China

The escalating trade tensions between the U.S. and China have sparked a significant change in global trade dynamics. With a 21% plunge in Chinese exports to the U.S. since July 2018, a new “bystander economy” has emerged. Mexico, seizing this opportunity, has become the biggest beneficiary, surpassing China as the top goods supplier for the U.S. This marks a historic shift in North American trade patterns.

Mexico’s success can be attributed to its strategic diversification efforts. The nation actively pursued economic complexity beyond its traditional oil and natural resource dependence. This approach, driven by data-driven strategies and a keen anticipation of global events, proved to be highly transformative.

A key part of this vision is Mexico’s “China Plus One” strategy. This strategy aims to mitigate the risks associated with the U.S.-China trade war while simultaneously capitalizing on the opportunities it presents. Mexico is actively seeking new trade partners and diversifying its export portfolio.

The Role of Supply Chain Diversification in Trade

Diversity isn’t just good; it’s smart business—especially when we’re talking supply chains between neighbors as close as cookies on a baking sheet. By reducing reliance on far-off lands like China and cozying up closer to home with the U.S., Mexico is making moves that matter.

- Better resilience: Less disruption means smoother sailing for businesses on both sides of the border.

- Faster turnaround: Closer production equals quicker delivery times — essential for staying competitive.

- Economic growth: This shift supports jobs and growth right where it counts—in our own backyard.

In essence, by spreading out its bets across different markets rather than relying heavily on one (I’m looking at you, China), Mexico is not only protecting itself against future disruptions but also bolstering trade relations with its northern neighbor—the U.S. and Canada—big time.

And guess what? That makes perfect sense because who doesn’t love having options?

This diversification dance could lead to some pretty exciting developments down south while offering juicy opportunities north of Rio Grande too.

Yep, these moves by Mexico might just be setting us up for an even stronger North American powerhouse duo. And let me tell you – I’m here for it.

✐ Key Takeaway:

Mexico is spicing up the supply chain scene by cutting down on its China dependency and getting cozy with the U.S. This smart shift means smoother business, quicker deliveries, and growth for both neighbors—making a stronger North American team.

Leading U.S. Exports and Imports in Trade with Mexico

Dive into the ebb and flow of trade between two powerhouse nations, where petroleum sings its siren song to Mexico, and cars zoom their way as top imports into the U.S.

Top U.S. Exports to Mexico: A Focus on Petroleum Products

Refined petroleum products play a starring role in the flourishing trade relationship between the United States and Mexico. In 2023, it topped the list of U.S. exports to Mexico, highlighting its crucial role in fueling both economies.

This goes beyond simply sending oil across borders. It’s a mutually beneficial exchange driven by economic necessity. Mexico possesses abundant crude oil reserves but lacks significant refining capacity. On the other hand, the United States has a well-developed refining infrastructure. This creates a natural win-win situation for both:

- Mexico: Mexico benefits by accessing a steady supply of refined petroleum products, essential for powering its industries and transportation sector.

- United States: The U.S. benefits by exporting these products, keeping its refineries operational, and creating jobs in the refining sector.

Petroleum products lead U.S. exports to Mexico, highlighting a crucial energy-economy synergy.

Cars as Leading Import: An Analysis

The automotive industry is a driving force behind the strong trade relationship between Mexico and the U.S. Both countries rely heavily on car imports from each other. Mexico is a major market for the U.S., absorbing everything from finished vehicles to cutting-edge electric vehicle technology.

This two-way flow is likely fueled by specialization, where each country focuses on producing different car parts or models. Mexico’s strength in auto parts production suggests it might export parts to the U.S. for assembly, while also importing completed vehicles or U.S.-made parts it doesn’t manufacture itself.

The North American Free Trade Agreement’s successor, USMCA, further strengthens this import-export relationship. By establishing rules of origin that require a significant portion of a car’s components to be produced within North America for duty-free access, USMCA incentivizes manufacturers in both countries to import parts and finished vehicles from each other.

Cars top Mexico’s exports to the U.S., underlining deep economic ties.

✐ Key Takeaway:

Dive into the trade tale where petroleum products and cars star in a cross-border exchange, spotlighting the mutual growth of U.S. trade with Mexico.

FAQs in Relation to U.S. Trade With Mexico

Who is Mexico’s largest trading partner?

The United States holds the title, thanks to a bustling trade flow that keeps both economies intertwined.

Why do the United States and Mexico have a strong trade relationship?

A shared border and hefty agreements like NAFTA turned USMCA cement this dynamic duo’s solid economic bond.

What is the value of trade between the U.S. and Mexico?

Last check? It’s over $600-$900 billion yearly. This mammoth figure underlines their deep-rooted commercial ties.

Conclusion

The relationship between the United States and Mexico is not just about geography; it’s a powerful economic partnership. Trade between these two nations has flourished for decades, but there’s always room for growth.

Exploring everything from tariffs to tech innovations has shown us one clear fact: The trade relationship between the U.S. and Mexico is a powerful force, influencing more than just market trends. This partnership teaches us important lessons about the value of working together across borders. It’s not just about boosting our economies; it’s about building a future together. Let’s use this relationship as a model for global cooperation, showing that unity leads to stronger progress.