Automotive tariffs are causing a stir in 2025 — especially for companies operating between Mexico and the United States. The U.S. has reinstated tariffs of 25% on steel and 10% on aluminum imports from several countries. This has forced automakers to rethink where they source and build their parts and how they move them.

However, amidst the chaos, there are opportunities. Mexico is right at the center of it.

Table of Contents

- Trade Turbulence in 2025

- Why Steel and Aluminum Tariffs Matter

- The Real Impact on the Automotive Industry

- Mexico’s Automotive Export Surge

- U.S. Automakers Are Shifting South

- Logistics: The Strategic Advantage

- How the ILS Company Supports Automotive Supply Chains

- FAQs

- What are the current automotive tariffs in 2025?

- Do these tariffs affect Mexican automotive exports?

- How are tariffs impacting car prices in the U.S.?

- Can U.S. companies avoid tariffs by nearshoring to Mexico?

- What challenges do automakers face under these new tariffs?

- How can the ILS Company help automotive manufacturers?

- Conclusion

Trade Turbulence in 2025

As of February 1, 2025, the United States reactivated Section 232 tariffs:

- 25% on steel imports

- 10% on aluminum imports

These tariffs target countries such as China, Turkey, Russia, and Vietnam. The aim is to reduce reliance on carbon-intensive imports and protect domestic industries. However, the result for the global automotive industry, especially in North America, has been rising costs, delays, and supply chain disruption.

Why Steel and Aluminum Tariffs Matter

Steel and aluminum are essential to vehicle manufacturing, including car bodies, frames, battery housings, suspensions, and more. When tariffs are imposed, the impact is immediate.

Price Increases Since January 2025

- Hot-rolled steel (U.S.): +12.1% ($890 to $998 per ton)

- Primary aluminum (LME): +8.5% ($2,420 to $2,625 per ton)

These changes have pushed up vehicle production costs by 4% to 7% across the board.

The Real Impact on the Automotive Industry

1. Higher Manufacturing Costs

More expensive materials mean higher input costs for automakers.

2. Consumer Price Hikes

According to J.D. Power, new car prices in the U.S. rose 5.6% in Q1 2025.

3. Delays in Assembly Lines

Auto plants in the U.S. and Mexico reported delays of two to three weeks due to material shortages.

4. Strain on Small Suppliers

Tier 2 and Tier 3 manufacturers that depend on non-USMCA imports are struggling to maintain margins or continue operations.

Mexico’s Automotive Export Surge

Unlike many other affected countries, Mexico remains tariff-exempt under the USMCA as long as origin rules are met. his has made Mexico the preferred partner for U.S. manufacturers.

Key Stats (INEGI, March 2025)

- 2.8 million vehicles exported from Mexico in 2024.

- 72% of those vehicles were exported to the United States.

- Steel exports to the U.S. increased by 9.4% YoY.

Nearshoring is accelerating, particularly in regions like Guanajuato, Coahuila, and Nuevo León. Automakers are shifting their supply chains to Mexico to lower costs and minimize risk.

U.S. Automakers Are Shifting South

To stay competitive, major automakers are expanding operations in Mexico:

- Stellantis: New investments in Saltillo.

- Ford: Scaling engine production in Chihuahua.

- GM: Centralizing parts production in the Bajío region.

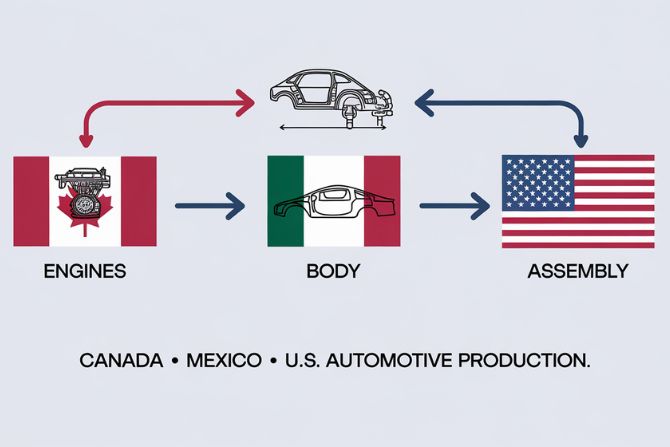

Many are adopting a trinational strategy:

- Canada for engine manufacturing.

- Mexico for body panels and key components.

- The U.S. handles final assembly and distribution.

This model optimizes costs, reduces exposure to tariffs, and improves time to market.

Logistics: The Strategic Advantage

In a post-tariff world, logistics isn’t just a support function — it’s a competitive advantage.

Efficient cross-border operations between Mexico and the U.S. require:

- Reliable transportation infrastructure.

- Expertise in customs and USMCA compliance.

- Smart routing to reduce delivery times and costs.

How the ILS Company Supports Automotive Supply Chains

As a strategic logistics partner, the ILS Company helps manufacturers adapt and thrive in this new trade landscape.

Our Services:

✅ End-to-End Logistics Solutions

We deliver from major Mexican cities to U.S. destinations via truck, rail, and ocean freight.

✅ Customs Compliance & USMCA Support

We provide origin verification and accurate classification to help you avoid unnecessary duties.

✅ Cargo Consolidation

Reduce costs and improve efficiency with smarter load management.

✅ Nearshoring Strategy Consulting

Identify ideal locations and build resilient regional supply hubs.

FAQs

1. What are the current automotive tariffs in 2025?

As of February 1, 2025, the U.S. reinstated tariffs of 25% on imported steel and 10% on aluminum under Section 232. These tariffs affect countries such as China, Russia, Turkey, and Vietnam, but they do not apply to Mexico or Canada under the USMCA, as long as origin requirements are met.

2. Do these tariffs affect Mexican automotive exports?

No. Mexico is exempt from U.S. automotive tariffs under the USMCA. Automotive products manufactured in Mexico that meet origin requirements can be exported to the U.S. without additional duties.

3. How are automotive tariffs affecting car prices in the U.S.?

Due to rising raw material costs, production costs have increased by 4-7%. According to J.D. Power, the average price of a new car in the U.S. increased by 5.6% in the first quarter of 2025.

4. Can U.S. companies avoid tariffs by nearshoring to Mexico?

Yes, by relocating production to Mexico, automakers and suppliers can reduce costs and avoid tariffs, provided that they meet the USMCA’s origin criteria. This strategy, known as nearshoring, is gaining momentum in 2025.

5. What challenges do automakers face under these new tariffs?

Key challenges faced by manufacturers today include:

- Rising material costs.

- Extended lead times.

- Instability among Tier 2 and Tier 3 suppliers.

- The need to realign logistics strategies.

Partnering with an experienced logistics company like ILS can significantly reduce these risks.

6. How can the ILS Company help automotive manufacturers?

ILS Company provides strategic logistics solutions such as:

- Cross-border transportation between Mexico and the U.S.

- USMCA-compliant customs consulting.

- Freight optimization through load consolidation.

- Nearshoring support, including regional hub setup and strategy development.

Conclusion

The return of automotive tariffs in 2025 is forcing a major reshaping of supply chains. However, while others are scrambling, Mexico is offering stability, cost savings, and a direct path to the U.S. market.

With the right strategy and logistics partner, such as the ILS Company, your business can transform trade disruption into a competitive advantage.

Ready to optimize your supply chain? Let’s plan your next steps together.